Why is setting up your banking information important?

Who doesn’t love to get paid? Make sure your banking information is ready to go on the Merchant Portal so your payouts run smoothly.

Who has access to my banking information?

Users added to the Portal have different levels of permissions for what they can update in the Merchant Portal. All Business Group Admins, Admins and Managers can edit and view banking information. Store Operators, however, cannot view or edit this information.

How do I add and update my direct deposit information?

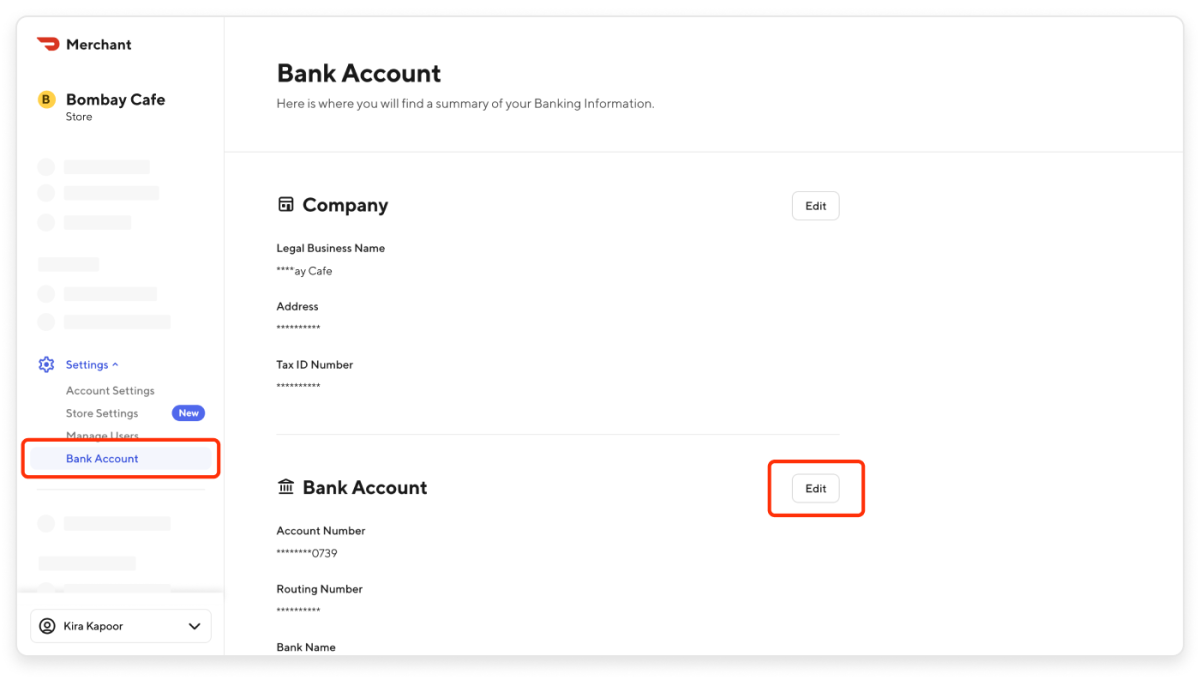

1. In the Merchant Portal, navigate to the Bank Account section.

2. To update your bank account information click on the Edit button.

3. Input new banking information in order to Save.

4. Once saved, you will then start to receive payments via direct deposit based on the new account information you have entered. If you are on weekly payouts, the payment period runs from Monday through Sunday. Payments are deposited to your bank account on Thursdays, and you will see the deposit hit your bank account on Friday for transactions that occurred the prior week.

How do I update my tax information?

Legal tax information is required for your store to remain compliant with banking regulations and operate without interruptions to your payments.

U.S. Restaurants

For your restaurant to be verified, we will need the following:

Business Licence

Photo ID (front and back)

IRS Letter 147C or IRS SS-4

This information can be added into the Merchant Portal:

1. In the Merchant Portal, navigate to the Bank Account section.

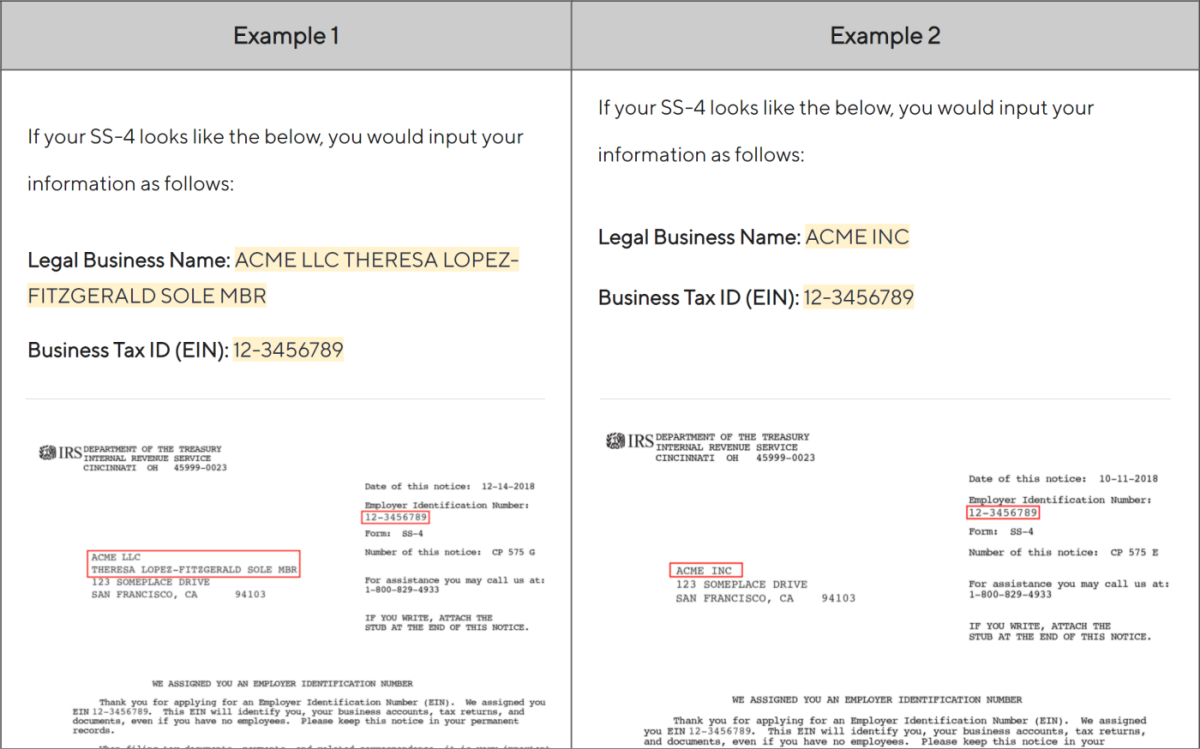

2. You can locate your tax information on your official IRS-issued documentation, such as the SS-4. If you cannot locate your IRS-issued documentation, you can input the Legal Business Name and EIN exactly as it is listed on your yearly income tax return.

3. On your SS-4, the Legal Business Name is on the left and the EIN is located in the top right corner of this form (it is a nine-digit number in the following format: XX-XXXXXXX).

4. Add this information to the tax section and click Save.

Canadian Restaurants

For your restaurant to be verified, we will need the following:

Business Licence (Provincially-issued legal document)

Photo ID (front and back)

A proof-of-entity document (e.g. tax doc with GST number from Canada Revenue Agency). If you do not have a Canada Revenue Agency GST number, you can use a proof-of-entity document from your Province. This is a document outlining that you’re a business operating out of your restaurant’s specific address.

This information can be added to the Merchant Portal:

1. In the Merchant Portal, navigate to the Bank Account section.

2. Input the above information into the tax section and click Save.